Zomato IPO

To order or not?

The line between customers and investors gets blurred starting today. - Kunal Bahl on IPO day

The Zomato IPO has de facto divided the investor community and the startup community into two! The traditional investors are trying to make a sense of the Rs 60,000 crore valuation and the tech community is hailing it as an inflection point in the India Start-up story. The lines are getting blurred here as, young investors below 25 years are driving this frenzy! Customers of the Internet economy turning into investors is great sign for the Indian internet economy.

Watershed moment for Startup ecosystem in India!

In terms of the Indian startup scenario, its a pivotal moment in its history. Zomato’s journey of 13 years from a start-up to to a Unicorn to IPO is quite inspiring. The success of the IPO will spur a new generation of entrepreneurs may be 10X! The internet economy in India is still in nascent stages and has tremendous opportunities to grow. India as its a large country and still underserved in terms tech adoption . Its also high time we see NIFTY with more new-age tech companies - ‘brick and click’ and necessarily only ‘brick and mortar’ companies! Zomato is the first in a series of consumer-centric (Paytm, Nykaa, Flipkart, Pepperfry next ) internet companies and startup in India to raise public money in a post-pandemic era. The rise of these new age companies also help in job creation.

Valuation woes!

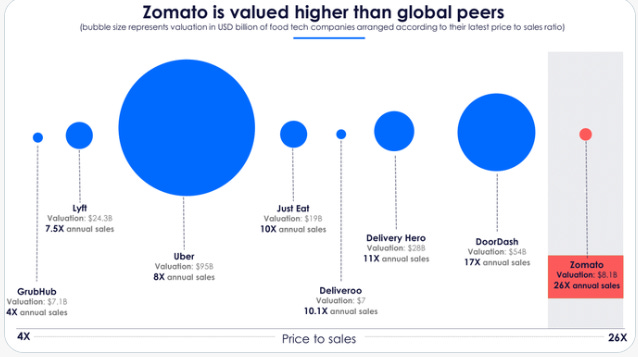

Zomato being the first among the tech startups to take route IPO, traditional valuations based on previous EBITDA figures , DCF methods etc. would not apply in this case. The market will price the stock overtime and someone averse to take IPO route for investing can wait till listing gains taper off. The company is still incurring losses and many are already worrying about dividends (many MFs already have these in their portfolio)

The dichotomy in terms for vs against will keep playing out . The traditional investor would have his reservations over valuation, business model etc and Start-ups will pursuing a positive view by adopting new business models etc.

I believe its a good opportunity for wealth creation for consumers of internet economy in the long run. India as such is quite behind the world in terms of adoption of new tech like AI, ML, AR/VR, Crypto, Blockchain and a host of emerging tech. There is huge appetite for growth and opportunities for start-ups to pivot into niche areas.

I have a bullish view of the overall India Startup story in the long run and hence have subscribed for the IPO and even if not allotted I would definitely invest in the secondary market after initial buzz around listing gains wanes away! Customers becoming investors would create value overtime and wealth for individuals. How all this will really play out only time will tell!

Whether its investing or start-ups there is only one eternal truth 'ignoramus et ignorabimus' - we do not know and we will not know!

Disclaimer : The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.'