Wrong Metrics Wrong Valuations

Need for realistic TAM, SAM & SOM metrics in Startup valuations.

An interesting debate has opened up on the actual number of users who can generate revenue in B2C tech businesses in Indian market. Nithin Kamath of Zerodha guesstimates it at around 15 crores max! Yes, you might be surprised seeing such a low number for a country of ~140 crore people!

His insights gives much needed reality check in terms of the inflated TAM ,startup valuations from an India Fintech perspective. He also emphasize the need for focus on sustainability of Fintech companies. I had written a piece on the very subject on chasing valuations in my last week’s post on Startup IPO valuations.

Nithin, who himself runs a highy successful bootstrapped Fintech company opines that not all businesses needs VC funding and chase valuations. The standout point is the role of misjudging the market size which in turn results in startup failures and chasing high valuations!

Optimistic Bias :

In terms of its consequences for decisions, the optimistic bias may well be the most significant cognitive bias. Because optimistic bias is both a blessing and a risk, you should be both happy and wary if you are temperamentally optimistic - Daniel Kahneman, Thinking, Fast and Slow

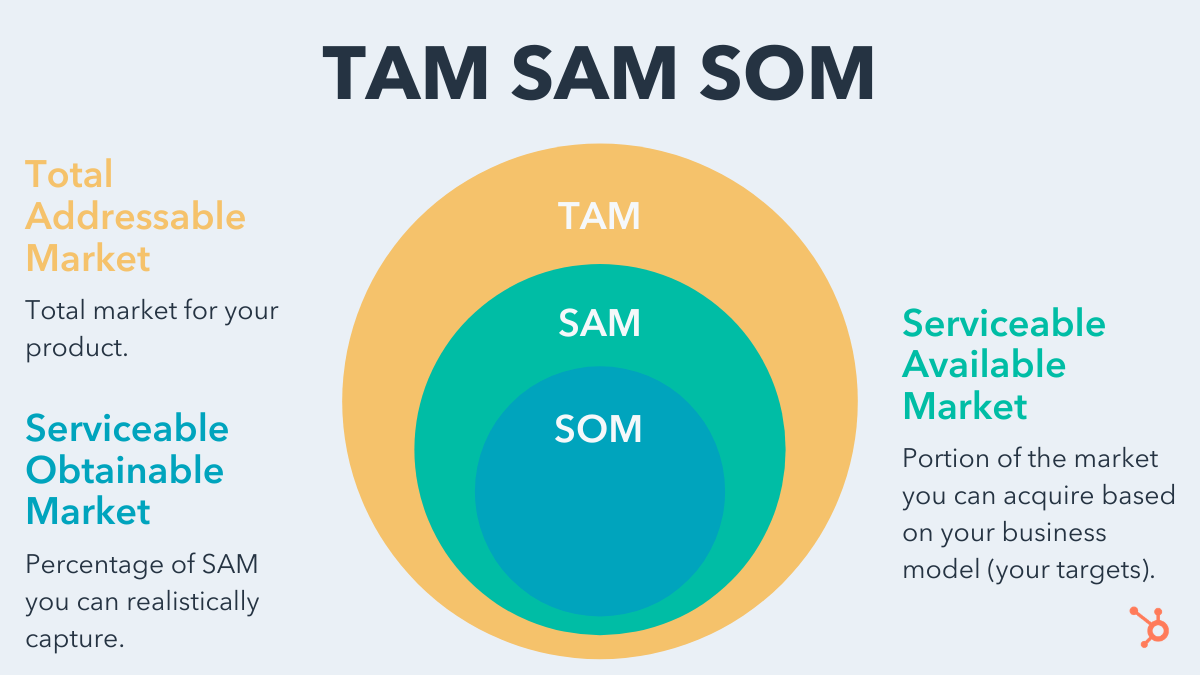

At any stage of business , be it seed or any series of funding, TAM SAM & SOM are the metrics part of any pitchbook and is extensively used to measure revenue opportunity available for a product or service. Entrepreneurs being optimists typically tend to have optimistic bias and take or discount risks. Misjudgments on these metrics eventually lead into WMWV (Wrong Metrics Wrong Valuations)

What is TAM SAM SOM?

TAM , SAM and SOM are acronyms of three metrics to describe the market organizations operates in. These metrics are key components of a business plan, particularly as one crafts his marketing and sales strategy, set realistic revenue goals, and choose to enter the markets that are worth ones time and resources.

Total Addressable Market (TAM)

Total addressable/Available market or TAM refers to the total market demand for a product or service. It’s the most amount of revenue a business can possibly generate by selling their product or service in a specific market. Total addressable market is most useful for businesses to objectively estimate a specific market’s potential for growth. Refining the calculation process leveraging credible market research data (Frost & Sullivan, Nielsen, Statista , & Gartner) is the key and during this critical phase of business.

SAM (Serviceable Addressable Market)

Due to the limitations of any business model (such as specialization or geographic limitations), we will not likely be able to service total addressable market. Serviceable addressable market is most useful for businesses to objectively estimate the portion of the market they can acquire to determine their targets. The quality of this metric is directly dependent and proportional to the quality of TAM metrics.

SOM (Serviceable Obtainable Market)

Unless ones a monopoly, they can’t capture 100% of your serviceable addressable market. Even if you only have one competitor, it would still be extremely difficult to convince an entire market to only buy your product or service. That’s why it’s crucial to measure your serviceable obtainable market to determine how many customers would realistically benefit from buying your product or service. Serviceable Obtainable market is most useful for businesses to determine short-term growth targets. The biggest misjudgments are competition neglect (potential obstacles and barriers to entry etc)

Competition Neglect

Colin Camerer, who coined the concept of competition neglect, illustrated it with a quote from a chairman of Disney Studios. Asked why so many big-budget movies are released on the same holidays, he said, “Hubris. Hubris. If you only think about your own business, you think, ‘I’ve got a good story department, I’ve got a good marketing department’ … and you don’t think that everybody else is thinking the same way.” The competition isn’t part of the decision. In other words, a difficult question has been replaced by an easier one.

This is a kind of dodge we all make, without even noticing. We use fast, intuitive thinking — System 1 thinking — whenever possible, and switch over to more deliberate and effortful System 2 thinking only when we truly recognize that the problem at hand isn’t an easy one.

The question that studio executives needed to answer is this: Considering what others will do, how many people will see our film? The question they did consider is simpler and refers to knowledge that is most easily available to them: Do we have a good film and a good organization to market it? - Daniel Kahneman , Thinking, Fast and Slow

Most FintechStartup founders can potentially have a confirmation bias wherein they neglect or underestimate the competition and changing market situations. The tendency to over-own this process will lead to WMWV - Wrong Metrics Wrong Valuations scenario.

Take away/ recommendations :

The TAM ,SOM & SAM metric calculations process needs to be more inclusive by talking to as many potential customers, tapping into credible market research sources, speaking to SMEs and industry leaders. The calculation process need to be more realistic aligned to the actual sales process and not just inflate the estimates to secure more funding!

While all these are best practices and metrics cant be 100% accurate , more due diligence is the need of the hour. Blindly going by non-credible sources would lead to faulty market sizing metrics etc. Tapping into specialists market research consultants might be a good option. As entrepreneurs, Optimistic bias can play out big time and its prudent to leverage services of qualified advisers, board members and also tap into community of other entrepreneurs in similar space.

If all entrepreneurs do this homework and get the methodologies right , metrics will be realistic. In the hindsight WMWV scenario can be avoided to a large extent. Importantly, can avoid Paytm type IPO valuation and disappointments. At right prices, Fintech startup IPOs can become attractive proposition for retail investors again!

Disclaimer : This is not investment advise , please contact SEBI RIA

Credits : HubSpot & book - Thinking , Fast and Slow - Daniel Kahneman