Globally, the pandemic situation has surely facilitated a plethora of wannabe entrepreneurs and stock traders in last couple of years! Mind you, startups have a fail rate of >90 % depending on multiple variables . It can vary as high as 97% in some geographies. The reasons can be many including :

No market need ~40%

Poor product ~20%

Ignore customers ~15%

Product mis-timed ~15% etc.

The bottom line is success rate would be in single digit!

Andrew has some handy suggestions :

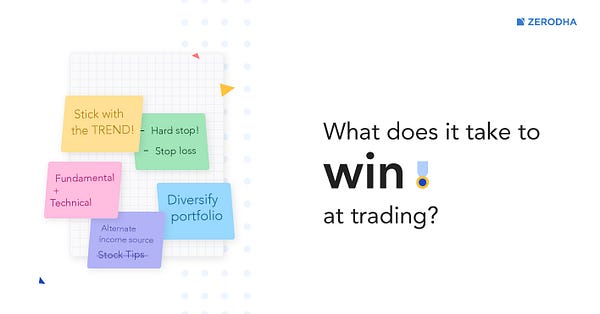

On the financial markets side, again a pandemic driven phenomenon, only 1% of active traders in India are making more money than Fixed Deposits! (which are around a lowly 5%!) Nithin from Zerodha has some really useful suggestions which can be very handy:

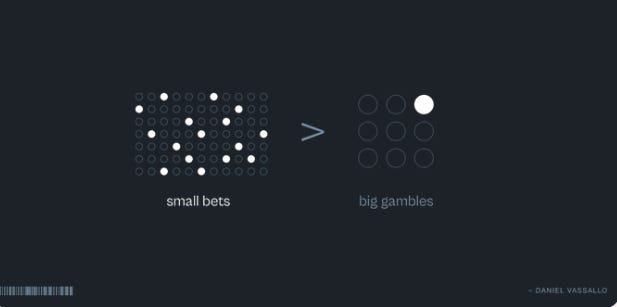

Whether you creating a startup/starting a new career or stock trading every one needs better odds. But the big question is how do you improve your odds? A portfolio of small bets approach/mental model can provide good insights. I found this thread by Daniel Vassallo very intriguing and resonated with me very well.

“Don't build a product. Build a portfolio of small bets.” @dvassalo

The nuanced approach to increase your odds is to hustle/side-projects before you build a full fledged startup and keep a day job while you trade. Both will help to reduce the financial stress and pressure to make daily profits. That said, this would take a whole new mindset/ mental model. I really liked the "portfolio of small bets" approach. Most of our "risk" perceptions in life are unidimensional! Further reading Nassim Taleb books and living those ideas can be more empowering.

In a creator economy context, a venture capitalist style approach/thinking may not be needed for solopreneurs to start with . The basic caveat remains that you are not chasing any numbers till you find the right product market fit. This means no early stage investing style thinking needed.

No chasing numbers for being unicorns

You need not know what others don’t know

No tight deadlines on a weekly basis.

Not every company needs to a unicorn and most things should not!

In a bear market context, sticking to the fundamentals would be my philosophy on investing (as I don’t trade!) In terms of trading, these suggestions can be handy :

No matter how sophisticated our choices, how good we are at dominating the odds, randomness will have the last word.

~ Nassim Nicholas Taleb