Post Zomato IPO: QSR theme

To junk or take a bite?

The modern struggle : Lone individuals summoning inhuman will power, fasting, meditating, and exercising, up against armies of scientists & statisticians weaponizing abundant food, screens, & medicine into junk food, news, social media, infinite porn, games & drugs - Naval

Didn’t get Zomato IPO allotment or was not bothered at all ? Never mind!

Quick Service Restaurant segment is making roaring business and it may make sense to take a bite out of this emerging market in India.

QSR is a good theme ?

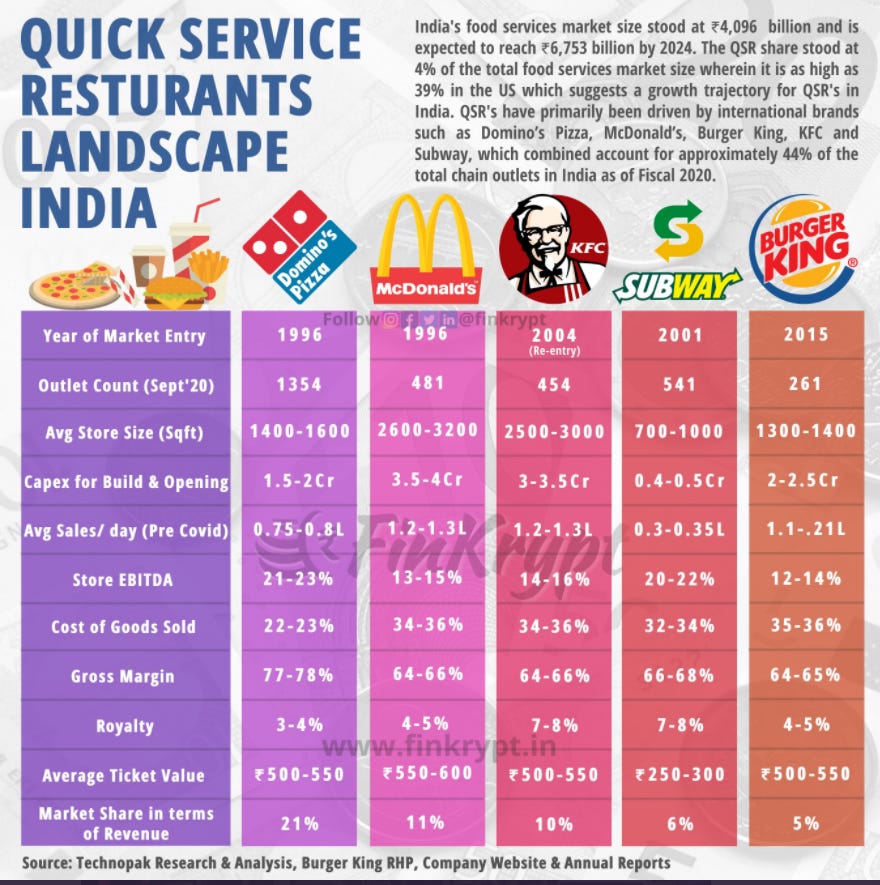

Quick Service Restaurant business is at inflection point India. Post-pandemic structural opportunities have enhanced for the overall QSR market. In India, out of the total food services market, QSR share stands at a mere 4% wherein it is as high as 39% in the US. Millennials are attractive customer targets because of their growing influence in this market & in terms of food habits Indian youngsters tend to ape western trends. This evolving consumer preferences & increasing innovation by the organized formats suggests a good growth trajectory for QSRs in India. Store expansion guidance is increasing by the day, supply chains getting better all companies eventually trying to become full stack '“Food-Tech” companies. In terms of Tech adoption, all companies are embracing Digital channels, AI/ML to improve customer experience, analytics and better product innovation. All in all for the next decade, QSRs could have a good run.

Jubilant Foodworks Vs Zomato

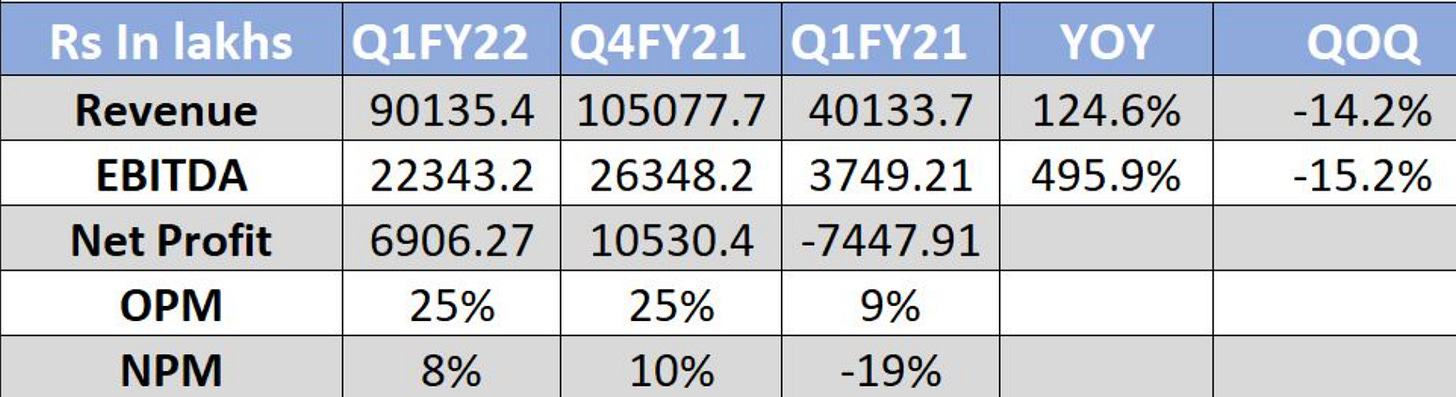

Zomato and Jubilant Foodworks though not strictly comparable, have two common grounds: control over the overall delivery experience and usage of customer data to drive growth (analytics) . Among the QSR players, Jubilant is the most efficient and holds much promise. Analysts stay positive on Jubilant Foodworks’ intent to become a fullstack food tech company and its plans for upping store addition guidance. Jubilant has its own fleet, is more profitable, has multiple brands, franchises. It’s App downloads are increasing (40 million registered users on their app , 6.8 million app downloads during the June quarter) Jubilant also has a good footprint in the Dine-in space and post pandemic recovery (almost fully vaccinated scenario, Jubilant can drive more growth and revenue ( Zomato May not as they stay focused on deliveries only and unless in a post IPO they decide to disrupt this segment with a changed business model)

Bottom-line:

Junkfood should come with warnings like cigarette packs - Rujuta Diwekar

The margin dynamics will play out well for operators like Jubilant as they have a good digital stack to engage their customers directly. In the long run, QSR players can be potential multi-baggers in the next decade or so. Both QSR and Zomato (IPO) and Swiggy (raised another $1.25 billion can co-exist to satiate the growing appetite of customers!

One must understand whether they like to eat or invest or both! Key is to factor their individual views on QSR theme, Food Tech evolution, perception on junk food, Health, ESG and valuation of these platform etc!

Disclaimer : The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.'