Meme stock and crypto frenzy!

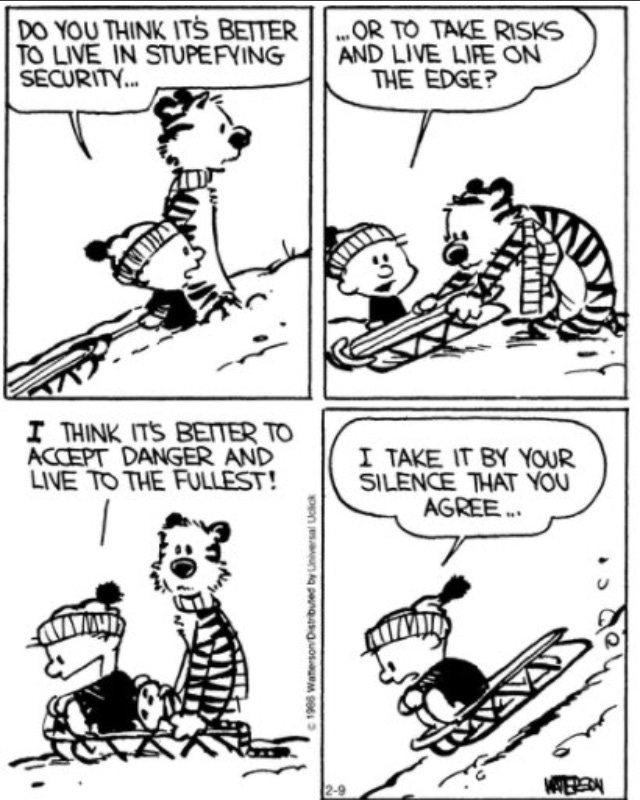

Time to revisit the definitions of trading, investing and speculating?!

“You will be much more in control, if you realize how much you are not in control.”

― Benjamin Graham, The Intelligent Investor

Benjamin Graham, The father of value investing and the top guru of finance and investment would have turned in his own grave seeing this!

PAWGcoin! A new crypto promoted by a former porn star was up roughly 900% last week! Her Instagram post holding the book Intelligent Investor by him was “liked” by 1.8 million people! It’s surely one of the signs that Crypto currencies are going out of control!

I wouldn’t be surprised if someone comes up with “SLeoneCoin” in India as that might go viral and become super successful!! Am damn sure about it factoring the massive fan following in India!!

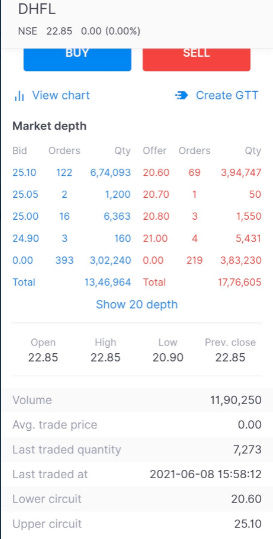

The DHFLCOIN!

A comparable absurdity played out in Indian stock markets last week , frenzied “meme traders” went trading on the scrip DHFL big time despite underlying risks .This stock (popularly called as the "Aishwarya Rai of Dalal Street" in its hey days) hit 10% upper circuit on multiple days! DHFL is currently part of the NCLT resolution and soon the value of the shares will be zero and trading stopping next week!

Meme stock trading isn’t manipulation! at least that’s what WallStreetBets says. The Wall street had its fair share of meme/speculative trading in stocks like AMC, GameStop and BlackBerry in the recent past. Not to be left behind, the meme trading took an interesting turn in Dalal street as well!

Irrational Exuberance - Novices trading on DHFL:

Meme scene in the US:

“If you’re in investing for excitement, you are a damn fool.” Index investing pioneer Jack Bogle

What’s driving this Meme madness? Is FOMO economy making any money? Are we downplaying the rise of the TikTok trading, Reddit threads etc.?

As per Jason Zweig, these meme traders are definitely “speculators” and not investors. There are some folks who are consciously playing the “dumb money” .They do read the companies’ financial statements, study the health of the underlying businesses and learn who else is betting on or against the shares and same the case with some informed investors. However, novice “meme traders” may fall in to “Bandwagon Effect” and follow “Reflexivity”. Retail investors would rush where institutional investors fear to tread! A situation where novices would be taken for a ride! This is how some of the wealth gets transferred between novices to informed investors.

The advent of discount brokers and low barrier entry coupled with pandemic remote working has amplified the entry of a new generation of FOMO stock traders. Cryptocurrencies too have low barriers to entry and trading, Thanks to Twitter, WhatsApp, and YouTube you’re probably fewer degrees away from someone sitting on a meme-coin fortune than you are from Kevin Bacon.

A sense of Déjà Vu: Paul Krugman, the Nobel Prize-winning economist has famously downplayed the impact of the Internet in 1998

“The growth of the Internet will slow drastically, as the flaw in ‘Metcalfe’s law' becomes apparent: most people have nothing to say to each other! By 2005, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s”

As we all know most of the predictions of most Economists and politicians turns out false and a similar situation is playing out in the stock trading and crypto markets.

The Nudge Effect

Some solutions to avoid meme trading include some responsible Brokers like Zerodha coming up with “Nudge” features on their products to help avoid mistakes while trading. This has helped to reduce the volumes on penny /dubious stock trading to a large extent.

Thankfully, the Indian regulator has relatively much stringent regulations in general and in terms of circuit breakers etc. they are quite robust compared to global markets norms.

SEC has already indicated that they have set sights on Meme stock trading and Cryptos in the US and similar initiative in Indian context may be needed.

The intersections of Virality and network effects of money on legacy financial markets and crypto markets are far reaching and needs more scrutiny and regulations.

The bottom line “ Social is eating the world”…There ain't no such thing as a free lunch!