Invest in what you know" -Peter Lynch

A question I have been asked recently is whether to invest in US stocks or not? Let me figure out the pros and cons!

The Rise of the millennial Investors

The millennials are taking a leading in terms of stock investing globally these days and India is no exception. The Millennial generation alsohave a affinity to invest in companies they frequently utilize, especially global Tech and Social media companies. Peter Lynch popularized the dictum “Invest in what you know” as the legendary manager of the Fidelity Magellan fund. That said, Peter Lynch also reminded that the Invest in What you know advice isn’t quite so simple & universal.

“I’ve never said, ‘If you go to a mall, see a Starbucks and say it’s good coffee, you should call Fidelity brokerage and buy the stock”

A similar analogy does play our to the current scenario in India . Users becoming investors is a good trend but with caveats. I had written a piece about meme-stocks frenzy last year (when Indian investors also piled up on meme stocks like AMC and GameStop etc.) . Its a risky proposition to follow the hype (mostly attributed to social media). The good old ‘Invest in What you know’ approach which includes understanding the company, business models, financials ’ like balance sheets etc is always a right approach.

Exploring the New territory

Understanding markets/mechanics you invest also is quite important . I had written a piece last year on how Online trading Gamification happens to a large extent in US markets. The mechanisms of trading in US differs a lot from India. Trading apps like Robinhood’ do not charge the traders on its platform. It earns through the Pay for Order Flow (PFOF) mechanism. The platform routes the orders to market makers who compensate the broker. India investors blindly following these can be a huge risk.

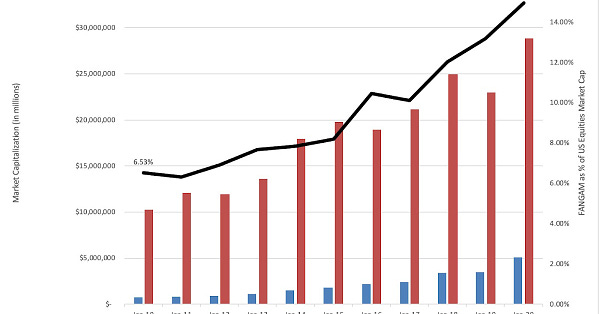

The FANGAM stocks are the ones that also has caught the imagination of young investors. FANGAM stocks are the most popular in US stock market and had a combined valuation of $7.1 trillion as of 2020, which is more than twice the GDP of India! The Dean of Valuation NYU professor Aswath Damodaran, has these insightful thread on his revisit analysis on FANGAM stocks :

Platforms in India for Investing in US market

A sort of democratization and access (which was previously available to only HNIs) coupled with pent up interest by millennials has facilitated a new breed of new trading platforms like Stockal, Vested, Groww, IndMoney, WinVesta etc. The latest addition to these avenues for US stock investing in India is facilitated by NSE themselves. IFSC GIFT city facilitates trading in select US stocks i.e., Amazon, Tesla, Google, Facebook, Microsoft, Netflix, Appleand Walmart (most of the FANGAM stocks)

The Cost factor

Investing in US stocks involves a new 5% tax on remittances + conversion fees by banks + brokerage fees by platforms etc. In my opinion, It does not make sense for small retail investors in India to invest in US stocks at this point in time . The portfolio diversification factor doesn’t apply here as the cost are relatively high.

Millennials investing in US stocks is just another frenzy and I would prefer investing in the India markets first. Once a portfolio reaches a threshold in terms tax and returns considerations, its prudent to start investingin US stocks( as the ticket size of investment would be high. I haven’t even delved much into the cost factors in details). Do check out this useful link : What they don’t tell you about investing in US Stocks from India?

The allure of fractional investing on US markets : As its not available in India, there is tendency to leverage this in US markets. However, they come along with a host of corporate actions related risks etc. It’s again important to remember that stocks in US would be in street name (factoring stock lending and other market mechanics there). In India we have Demat accounts which would be in our names and much more safer!

I believe the regulatory framework is much robust in India and fractional investing doesn’t work for us as of now. We will end up coming back to ‘Invest in What you know’ debate. Geo-politics can also lead to Alibaba, delisting type of scenarios and its better to stick to India markets and at least we have “nudge” features which protect investors to a large extent (you may not see those features with US brokers as their operating models are different). Overall regulatory requirements in India in-terms of margins, circuit breakers process etc is relatively better from an investor perspective.

The Verdict ‘ Invest in What you know!’

When the food at home is so tasty, why go out and eat? - Rakesh Jhunjhunwala